Offshore hiring has emerged as a transformative strategy for American businesses seeking to optimize costs, access specialized talent, and foster innovation. The allure of a global talent pool, coupled with significant cost efficiencies, makes offshore outsourcing an increasingly attractive proposition. However, this strategic move comes with its own set of complexities, particularly concerning legal compliance, effective task tracking, and seamless salary disbursement. This comprehensive guide, tailored for American business owners, delves deep into these critical aspects, offering a multi-dimensional perspective to ensure successful and compliant offshore operations. We aim to equip you with the knowledge and tools to confidently navigate the intricacies of global hiring, transforming potential challenges into strategic advantages.

In an increasingly interconnected world, the traditional boundaries of business operations are blurring. American businesses, from burgeoning startups to established enterprises, are increasingly looking beyond their national borders to find talent, reduce costs, and accelerate growth. This fundamental shift defines offshore hiring, a strategic move with profound implications for competitive advantage.

Why American Businesses Are Looking to Hire Offshore?

The motivations behind offshore hiring are multifaceted, extending far beyond simple cost-cutting. For American businesses, it represents a strategic avenue to overcome domestic challenges and capitalize on global opportunities. While cost savings offshore hiring remains a primary driver, the value proposition is far more sophisticated than merely exploiting lower wage rates. The lower cost of living in many offshore locations translates to a significantly lower operational overhead for businesses. This includes reduced expenses for office space, utilities, and even certain benefits. For instance, a software developer in Southeast Asia or Eastern Europe might command a salary significantly lower than their US counterpart, yet possess comparable or even superior skills. This isn't just about paying less; it's about getting more value for every dollar invested, allowing businesses to reallocate resources to innovation,

Offshore hiring has emerged as a transformative strategy for American businesses seeking to optimize costs, access specialized talent, and foster innovation.The allure of a global talent pool, coupled with significant cost efficiencies, makes offshore outsourcing an increasingly attractive proposition.However, this strategic move comes with its own set of complexities, particularly concerning legal compliance, effective task tracking, and seamless salary disbursement. This comprehensive guide, tailored for American business owners, delves deep into these critical aspects, offering a multi-dimensional perspective to ensure successful and compliant offshore operations. We aim to equip you with the knowledge and tools to confidently navigate the intricacies of global hiring, transforming potential challenges into strategic advantages.

The Employer of Record (EOR) model is increasingly popular for American businesses looking to hire individual employees in foreign countries without establishing a local entity.An EOR is a third-party organization that legally employs the workers on behalf of the client company.The EOR handles all legal, payroll, tax, and HR responsibilities in the host country, including global payroll, international employment law compliance, and benefits administration. The client company retains full control over daily tasks and management of the offshore employees. This model significantly mitigates legal compliance offshore hiring risks, as the EOR bears the responsibility for adherence to local labor laws, making it an ideal solution for businesses seeking to expand globally with minimal administrative burden and legal exposure. We will delve deeper into the transformative role of EOR services throughout this article.

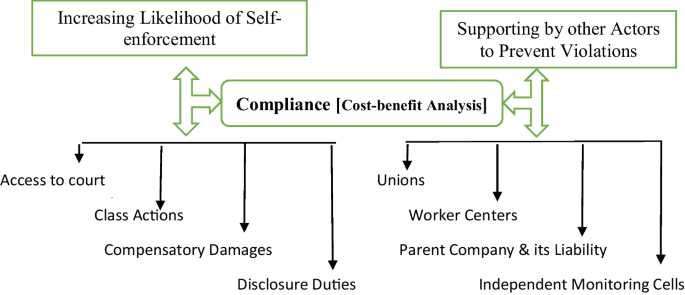

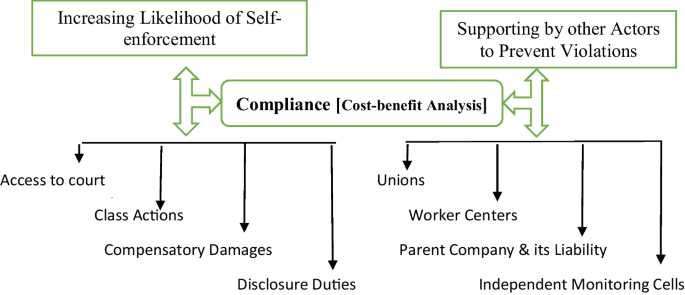

The single most critical aspect of successful offshore hiring for American businesses is undoubtedly legal compliance offshore hiring. Failure to adhere to the intricate web of domestic and international regulations can lead to substantial fines, legal disputes, reputational damage, and even forced cessation of operations. This section unpacks the multi-layered legal considerations and offers actionable guidance. Offshore hiring is not a one-size-fits-all legal landscape. It involves navigating the laws of both the home country (USA) and the host country where the offshore talent resides, along with potential international agreements.

Home Country (USA) Laws: FLSA, FMLA, ADA, and More

Even when hiring offshore, American businesses must remain cognizant of certain US laws that may have extraterritorial reach or influence their overall operations. Key federal laws include:

Fair Labor Standards Act (FLSA): While generally governing minimum wage, overtime pay, recordkeeping, and child labor standards for employees within the US, aspects of FLSA (e.g., proper classification of workers) can indirectly impact offshore arrangements, particularly concerning misclassification risks.

Family and Medical Leave Act (FMLA): Provides eligible employees with up to 12 weeks of unpaid, job-protected leave for specific family and medical reasons. While direct applicability to offshore workers is limited, a US parent company might face scrutiny if its offshore practices contradict the spirit of such laws, especially when considering "employee" status.

Americans with Disabilities Act (ADA): Prohibits discrimination against individuals with disabilities. Again, direct applicability to offshore workers is limited, but companies should consider global best practices for inclusivity.

National Labor Relations Act (NLRA): Protects the rights of most private sector employees to organize, bargain collectively, and engage in other protected concerted activities. While mainly US-focused, any attempt to interfere with offshore workers' rights, if they were deemed "employees" under a US nexus, could potentially be problematic.

Title VII of the Civil Rights Act: Prohibits employment discrimination based on race, color, religion, sex, and national origin. While typically US-centric, maintaining fair and non-discriminatory practices globally is a best practice.

Tasks Tracking and Performance Management in a Distributed Environment

Once the legal groundwork is established, the operational success of offshore hiring hinges on effective tasks tracking remote teams and robust performance management. The shift from a co-located team to a distributed workforce necessitates a re-evaluation of traditional management approaches.

The Evolution of Work: From Cubicles to Clouds

The global pandemic accelerated a trend already in motion: the decentralization of the workplace. Today, many American businesses are embracing a hybrid or fully remote model, making the principles of managing offshore teams increasingly relevant for onshore remote employees as well. The key is to shift focus from "presenteeism" to productivity and results.

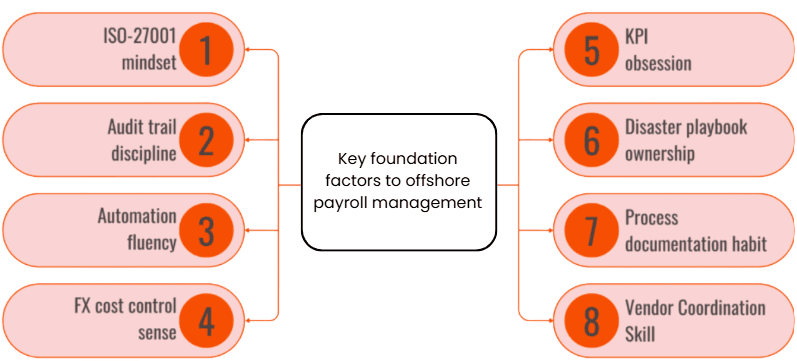

Setting Clear Expectations and KPIs for Offshore Teams

Ambiguity is the enemy of productivity in a distributed setting. Crystal-clear expectations and measurable Key Performance Indicators (KPIs) are fundamental.

Defining Deliverables and Quality Standards

Specificity: Avoid vague instructions. Define exactly what needs to be delivered, in what format, and by when.

Examples & Templates: Provide examples of high-quality work or templates for common tasks to ensure consistency.

Version Control: Utilize systems (e.g., Git for code, Google Drive for documents) to manage versions and avoid confusion.

Establishing Measurable Objectives

KPIs should be quantifiable and tied to business goals. Examples include:

Customer Service: Average handling time, customer satisfaction (CSAT) scores, first-call resolution rate.

Software Development: Lines of code, bug resolution rate, sprint velocity, on-time project completion.

Data Entry: Accuracy rate, volume of entries per hour.

Marketing: Website traffic, lead generation, conversion rates.

Leveraging Technology for Effective Task Tracking

Technology is the backbone of efficient offshore team management. Investing in the right tools can bridge geographical gaps and enhance productivity.

Empowering American Businesses in the Global Economy

Offshore hiring is no longer just a trend; it's a fundamental shift in how American businesses operate in a globalized economy. By strategically leveraging international talent, companies can unlock unparalleled cost efficiencies, access diverse skill sets, and achieve significant scalability. However, the path to successful offshore engagement is paved with critical considerations, particularly concerning legal compliance offshore hiring, effective tasks tracking, and seamless salary disbursement.

This comprehensive guide has aimed to demystify these complexities, providing a multi-dimensional view for business owners seeking to harness the power of global talent. From understanding the nuances of international employment law and the vital role of Employer of Record (EOR) services in mitigating risks, to implementing robust digital tools for tasks tracking remote teams and ensuring accurate global payroll, every aspect is crucial.

The journey may present challenges – cultural differences, communication barriers, and the ever-evolving regulatory landscape – but with careful planning, robust due diligence, strategic technological adoption, and a genuine commitment to fostering inclusive, high-performing global teams, American businesses can transform these challenges into profound competitive advantages.

For Bpohub's audience – business owners poised to embrace the future of work – offshore hiring represents not just a cost-saving measure, but an opportunity for unprecedented growth, innovation, and resilience in a dynamic global marketplace. The right strategy, coupled with meticulous attention to legal, operational, and financial details, empowers your business to thrive beyond traditional borders, securing a truly global competitive edge.