The contemporary business landscape in the United States is characterized by relentless competition, rapid technological advancements, and dynamic market shifts. For many organizations, particularly small and medium-sized enterprises (SMEs), maintaining agility, optimizing efficiency, and sustaining strategic focus are paramount for survival and growth. Within this demanding environment, the intricate and often resource-intensive domain of accounting and finance frequently absorbs disproportionate amounts of time and capital, diverting critical attention from core operational and strategic imperatives. This introductory section establishes the burgeoning recognition among business leaders that traditional, fully in-house financial management models may no longer represent the most effective or sustainable approach.

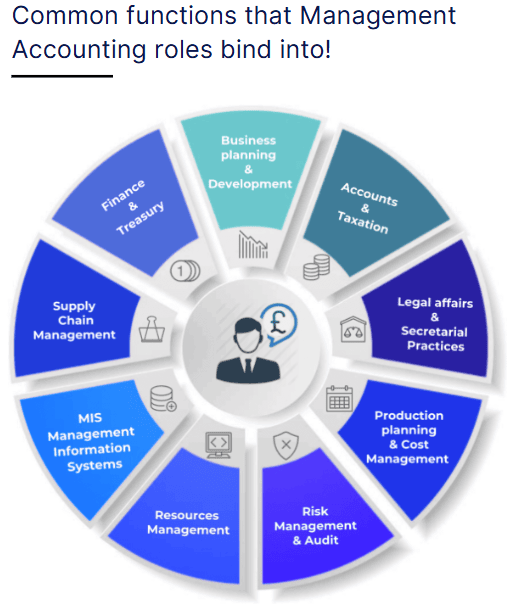

Finance and Accounting (F&A) outsourcing involves the strategic delegation of various financial functions to external service providers. This encompasses a broad spectrum of tasks, ranging from fundamental transactional processes like bookkeeping, payroll management, and tax preparation to more complex and strategic functions such as accounts payable and accounts receivable management, and high-level financial planning and analysis. This operational model allows businesses to leverage specialized expertise and advanced technologies without the associated overheads of an internal department.

The immediate value proposition of F&A outsourcing lies in its direct ability to address common financial pain points experienced by US businesses. By entrusting these specialized functions to external experts, organizations can significantly optimize costs, enhance operational efficiency, and gain access to a depth of expertise that might otherwise be unattainable. This strategic shift transforms financial management from a burdensome necessity into a powerful lever for competitive advantage, enabling business owners to reallocate resources and focus on activities that directly drive innovation and market expansion.

The Modern Financial Landscape: Challenges & Opportunities for US Businesses

The operational realities for US business owners are complex, often requiring them to assume multiple roles simultaneously. Beyond their primary entrepreneurial vision, they frequently find themselves navigating responsibilities typically assigned to marketing managers, human resources directors, and customer service representatives. This multi-faceted engagement, while showcasing versatility, renders effective financial management particularly arduous. The inherent demands of recording, summarizing, and analyzing financial transactions can overwhelm internal capacities, creating significant operational bottlenecks and strategic limitations.

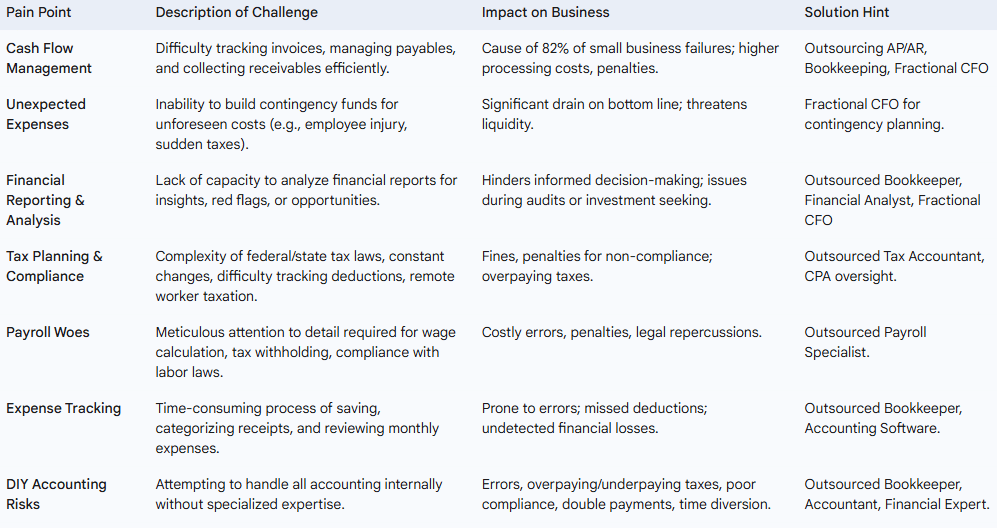

Navigating Common Accounting and Financial Pain Points

The challenges inherent in managing accounting and finance functions are pervasive across US businesses, particularly within the SME sector. These difficulties often transcend mere inconvenience, directly impacting a company's stability and growth trajectory. One of the most critical and frequently cited pain points is cash flow management. Poor cash flow is not merely an inconvenience; it is a fundamental vulnerability, identified as the cause of 82% of small business failures. Businesses frequently struggle with effectively tracking the status of invoices and payments, leading to a lack of clear visibility into their cash flow and liabilities. Inefficient accounts payable processes can escalate processing costs per invoice, including labor, and incur potential penalties for late payments. Furthermore, diligently collecting customer payments, a seemingly straightforward task, often proves challenging, impacting the inflow of funds. Seasonal businesses face exacerbated challenges in managing irregular cash flow patterns, where periods of high revenue are offset by lean months, necessitating meticulous financial foresight.

Another significant concern revolves around unexpected expenses. Many small businesses find it exceedingly difficult to build adequate contingency funds for unforeseen costs. Events such as an employee injury without sufficient workers' compensation insurance, a sudden, one-time government tax, or an abrupt vendor price hike can severely deplete financial reserves and negatively impact the bottom line. The inherent financial volatility makes it challenging for business owners to consistently set aside money for such "rainy days," leaving them exposed to significant financial shocks.

The realm of financial reporting and analysis also presents considerable hurdles. Beyond the routine tasks of day-to-day bookkeeping, many businesses lack the capability to consistently analyze financial reports for deeper insights, early warning signs, or emerging opportunities. This deficiency in analytical capacity hinders informed decision-making, particularly for entities seeking external investment or undergoing financial reviews and audits, where well-documented and insightful records are expected by lenders, investors, and tax authorities. The core difficulty often lies not in generating data, but in discerning which metrics truly matter to various stakeholders and how to extract actionable intelligence from disparate data sources.

Tax planning and compliance represent a perpetual source of stress and complexity. The labyrinthine nature of federal and state tax laws, coupled with their constant evolution, makes accurate planning and timely filing a formidable task. Varying state regulations regarding tax rates, credits, and deductions, alongside the complexities introduced by remote workforces, make tracking tax-deductible expenses and ensuring correct withholdings exceptionally difficult. Failure to meet estimated quarterly tax obligations or comply with specific regulations can result in substantial fines and penalties.

Payroll management is another area fraught with potential pitfalls. This function demands meticulous attention to detail and stringent compliance with local labor laws. Errors in employee classification, incorrect tax filings, inaccurate employee payments, or improper tracking of time off can lead to costly penalties and legal repercussions.

Effective expense tracking is vital for profitability, yet it often becomes unwieldy. Saving and categorizing every receipt, systematically reviewing monthly expenses, and accurately identifying legitimate tax deductions can be time-consuming and prone to oversight. Unthinking bill payments without proper reconciliation can lead to double payments or undetected errors, resulting in financial losses.

A significant underlying issue is the pervasive practice of Do-It-Yourself (DIY) accounting. While seemingly cost-effective initially, attempting to handle all accounting functions internally without specialized expertise frequently results in critical errors, such as overpaying or underpaying taxes, poor tax compliance, or duplicate invoice payments. This approach, rather than saving resources, often diverts the business owner's invaluable time and energy away from core business growth activities, ultimately proving more costly in the long run. The fundamental problem here is not merely about managing tasks; it is about a critical expertise gap that directly translates into business vulnerability. When business owners, despite their entrepreneurial acumen, attempt to navigate the complexities of financial management without specialized knowledge, it leads to inefficient processes and a lack of critical financial insights. This, in turn, increases financial risk and can even jeopardize the fundamental viability of the business. The chain of events is clear: a deficit in internal accounting expertise, often stemming from DIY attempts, leads to flawed financial operations, which then exposes the business to significant risks, including the high rate of failure linked to poor cash flow management.

Finally, the reluctance or inability to fully embrace accounting technology remains a challenge. Many small businesses continue to rely on outdated manual methods, such as basic Excel spreadsheets, for their financial tracking. This resistance to adopting modern accounting software and automation tools means they miss out on significant gains in efficiency, control, and real-time financial visibility. The perception of accounting software as an unnecessary expense, or a hesitation to learn new systems, can hinder growth and limit a business's potential. The constant evolution of tax laws and regulatory frameworks, coupled with the inherent apprehension surrounding audits, underscores a substantial compliance burden. This burden is not simply an administrative inconvenience; it represents a profound strategic drain on resources. Business owners find themselves pulled away from vital growth-oriented activities—such as product development, market expansion, or customer engagement—to dedicate time and mental energy to ensuring regulatory adherence. In this context, outsourcing financial compliance becomes more than a convenience; it transforms into a strategic imperative. It offers regulatory peace of mind by entrusting complex, ever-changing requirements to specialized experts, thereby enabling the reallocation of internal resources towards initiatives that directly drive business growth and competitive advantage.

The table below summarizes these common accounting pain points for US small and medium-sized businesses and their significant impact.

The Strategic Shift: Why Outsourcing is Becoming the New Normal

The confluence of the financial challenges outlined above and the dynamic evolution of the global market is catalyzing a profound transformation in how US businesses approach their finance and accounting functions. Outsourcing is no longer merely a tactical measure for cost reduction; it has rapidly evolved into a strategic imperative for maintaining competitiveness and fostering sustainable growth.

The market growth and trends within the Finance and Accounting Outsourcing (FAO) sector underscore this strategic shift. The global FAO market is substantial, with an estimated valuation of USD 54.79 billion in 2025, and projections indicating a robust expansion to USD 81.25 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 8.21% during this period. North America stands as the largest market for FAO, with US companies alone anticipated to invest nearly $50 billion in outsourcing services over the next 12 months. While large enterprises (those with revenues exceeding $5 billion) account for over half (53%) of the global Business Process Outsourcing (BPO) market expenditure, a significant 25.2%, equating to $34.8 billion, originates from businesses with annual revenues between $50 million and $1 billion. This substantial mid-market adoption clearly signals the increasing relevance and opportunity for Bpohub's target audience of growing business owners.

A primary catalyst for this strategic shift is the acute talent shortage plaguing the accounting profession. Over the past two years, more than 300,000 US accountants and auditors have exited the workforce, with only approximately 136,400 new openings projected annually over the next decade. Some analysts even forecast that the shortage of skilled accountants could reach a staggering 3.5 million by 2025. This severe talent gap directly fuels higher salary expectations for the remaining qualified candidates, rendering in-house recruitment and retention increasingly challenging and costly for businesses. This acute scarcity of qualified accountants is a direct driver of the escalating demand for F&A outsourcing. Businesses are not merely seeking to cut costs; they are increasingly compelled to seek external expertise to maintain essential financial operations, as the necessary skills are simply unavailable or prohibitively expensive within the traditional hiring market. This dynamic transforms outsourcing from a mere option into a critical necessity for sustaining financial functions and ensuring business continuity.

The accelerated pace of digital transformation, significantly propelled by the COVID-19 pandemic, has further cemented outsourcing's role. The pandemic necessitated a rapid transition to remote work models, leading to a surge in reliance on digital tools for accounting and finance. This environment has fostered a heightened demand for outsourced solutions that are inherently built upon and leverage advanced cloud-based platforms, automation, and artificial intelligence (AI). The increasing adoption of AI, automation, and cloud-based solutions within the F&A outsourcing market extends beyond simple operational efficiency. It fundamentally positions outsourcing as a primary conduit for SMEs to access cutting-edge financial technology and achieve digital agility without the prohibitive upfront investment required for internal implementation. This capability allows businesses to transform their financial operations from a reactive, manual process to a proactive, data-driven function, thereby becoming a significant driver of competitive advantage in an increasingly digitized global economy.

Unpacking Commonly Outsourced Accounting and Finance Roles

Outsourcing within the accounting and finance domain is far more expansive than merely delegating basic data entry. It encompasses a comprehensive spectrum of roles, spanning from foundational transactional tasks that form the bedrock of financial records to high-level strategic advisory functions that guide a company's future. This multi-dimensional approach empowers businesses to meticulously tailor outsourcing solutions to their precise requirements, effectively filling specific skill gaps or offloading entire departments to external experts. The strategic implication is that outsourcing is not just about offloading mundane tasks; it's about gaining access to a tiered structure of financial expertise that can evolve with a business's needs, enabling a profound transformation from reactive financial management to proactive strategic planning. This flexible access to specialized skills allows businesses to scale their financial capabilities dynamically, ensuring that financial management becomes an enabler of growth rather than a constraint.

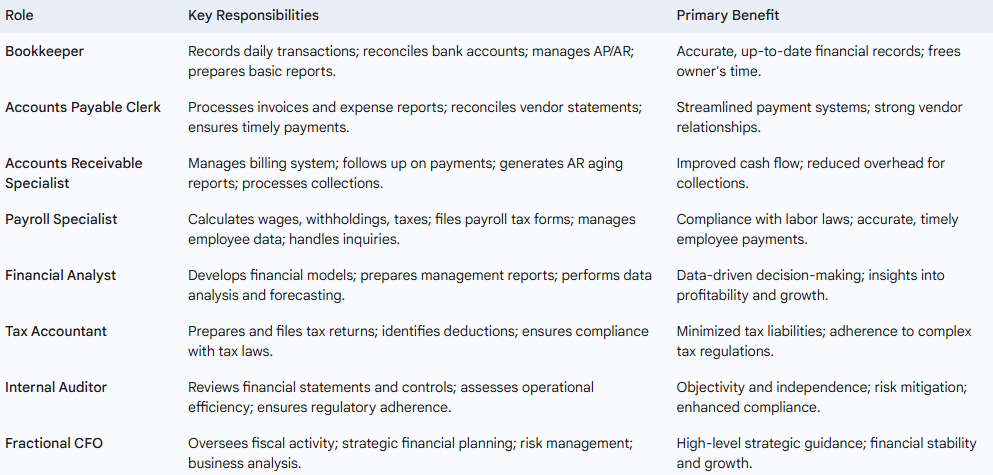

Foundational Financial Operations: Transactional Roles

These roles form the core of a business's daily financial activities, ensuring that transactions are accurately recorded, processed, and reconciled. They are the operational backbone that supports all subsequent financial analysis and reporting.

Bookkeepers: The Backbone of Accurate Records

Outsourced bookkeepers serve as the indispensable foundation for maintaining a business's financial health. Their primary responsibility involves meticulously recording and tracking all daily financial transactions, ensuring that every inflow and outflow of funds is accurately captured.

The core duties of an outsourced bookkeeper typically include:

- Data entry: This involves the precise input of all financial transactions into the accounting system.

- Reconciling bank accounts and credit card statements: A critical task that ensures consistency between internal records and external financial statements, identifying and resolving any discrepancies.

- Managing accounts receivable and accounts payable: This dual responsibility involves tracking customer invoices and diligently following up on payments due (accounts receivable), as well as processing vendor bills and managing expense reports for payments owed by the business (accounts payable).

- Producing monthly reports and financial statements: Compiling essential financial documents such as profit and loss statements, balance sheets, and cash flow statements to provide a snapshot of the business's financial health.

- Gathering information for tax filings: Systematically collecting and organizing all necessary financial data required for accurate and timely tax preparation.

- Running payroll: Ensuring employees are paid correctly and on time, including calculations for wages, deductions, and withholdings.

The value proposition of an outsourced bookkeeper is profound: they ensure the maintenance of accurate, up-to-date financial records, which are absolutely essential not only for regulatory compliance but also for informed strategic planning. By entrusting these meticulous and often time-consuming tasks to external professionals, business owners are freed from the administrative burden, allowing them to redirect their focus and energy towards core business activities that drive growth and innovation.

Accounts Payable & Receivable Clerks: Optimizing Cash Flow Cycles

Accounts Payable (AP) and Accounts Receivable (AR) clerks play distinct yet complementary roles in optimizing a company's cash flow cycle. These specialists ensure the efficient management of both incoming and outgoing funds, directly impacting a business's liquidity and financial health.

Accounts Payable (AP) Clerks are specifically tasked with managing a firm's outgoing payments to various entities, including suppliers, vendors, banks, creditors, and other third-party organizations to whom money is owed. Their responsibilities are comprehensive and detail-oriented:

- Handling and managing expense reports and invoices: This involves processing and organizing all incoming expense reports and vendor invoices.

- Making journal entries and posting to the general ledger: Accurately recording financial transactions as journal entries and ensuring their timely and correct posting to the general ledger.

- Reconciling credit card and bank accounts: Comparing and matching internal records with external statements to ensure consistency and identify discrepancies.

- Verifying, recording, and categorizing all data relating to accounts payable: Ensuring the accuracy, proper recording, and correct categorization of all data pertaining to payments owed by the firm.

- Crafting financial reports on accounts payable data: Generating insightful reports that provide a clear overview of the firm's accounts payable status.

- Ensuring accurate and smooth functioning of overall AP processes and operations: Playing a pivotal role in maintaining the efficiency and correctness of all accounts payable procedures.

- Generating purchase orders as needed: In some roles, AP clerks may also be responsible for creating purchase orders to initiate procurement.

- Ensuring GAAP compliance: Adhering to Generally Accepted Accounting Principles (GAAP) throughout all accounts payable processes.

The value proposition of an outsourced AP clerk lies in ensuring the accuracy and timeliness of payments, which in turn streamlines payment systems, enhances the overall financial health of the business, and fosters strong, lasting relationships with vendors and suppliers.

Accounts Receivable (AR) Specialists, conversely, are responsible for managing payments owed to the firm from its customers. Their diligent efforts are focused on converting unpaid invoices into actual cash, directly influencing the company's ability to meet its own obligations and sustain operations. Their core duties include:

- Updating and maintaining the billing system: Ensuring that the billing system accurately reflects amounts due and is updated promptly upon payment.

- Following up on collected and allocated payments: Investigating and resolving any issues related to payments received or allocated, including discussing payment extensions with clients.

- Processing billing, collection, and reporting activities according to deadlines: Handling the entire cycle from invoice generation to payment collection and subsequent reporting, ensuring adherence to established timelines.

- Generating and reviewing AR aging to ensure compliance: Creating and analyzing aging reports (e.g., 30, 60, 90 days overdue) to identify overdue accounts and initiate appropriate follow-up actions.

- Performing account reconciliations and maintaining Accounts Receivable customer files and records: Comparing internal financial records with bank statements to ensure accuracy and maintaining comprehensive customer payment histories.

- Processing cash and receipts according to established protocols, and preparing bank deposits: Collecting incoming payments and ensuring their secure and timely deposit into the company's bank accounts.

- Making process adjustments, creating a recovery system, and starting the collection process: Adjusting ledgers for collected funds, developing strategies for recovering outstanding debts, and initiating formal collection efforts for non-paying clients.

The value proposition of outsourcing AR functions is significant: it accelerates invoicing and payment cycles, substantially improves cash flow, reduces internal overhead costs associated with collections, and allows the business to dedicate more time and resources to core revenue-generating activities.

Payroll specialists are critical for maintaining employee morale and ensuring strict adherence to labor and tax laws. Their role is highly sensitive, requiring meticulous attention to detail and up-to-date knowledge of ever-changing regulations.

The responsibilities of an outsourced payroll specialist typically encompass:

- Payroll processing: The fundamental duty involves accurately calculating employee wages, including regular pay, overtime, bonuses, and commissions, and ensuring that all employees are paid correctly and on time. This also includes the precise withholding of federal, state, and local taxes, as well as deductions for benefits and other contributions.

- Tax reporting and filing: Managing the complexities of payroll tax reporting, which involves preparing and filing various federal and state payroll tax forms (e.g., Forms 941, 940, state unemployment tax forms). They ensure all tax payments are made punctually and that end-of-year tax documents, such as W-2s and 1099s, are accurately prepared and distributed to employees and relevant authorities.

- Employee data management: Maintaining and updating comprehensive employee data, including personal information, employment history, wage details, and records of employee benefits. Accurate and current data is vital for compliance, efficient human resources management, and overall employee satisfaction.

- Direct deposits and payment distribution: Overseeing the setup and ongoing management of direct deposit systems and other payment methods. They ensure that payments are timely and secure, whether through direct deposit, physical checks, or other instruments, thereby enhancing the reliability of the payroll system.

- Handling employee inquiries: Serving as a dedicated point of contact for employees regarding payroll-related questions and concerns. This includes addressing queries about pay calculations, deductions, benefits, and time off, ensuring prompt and professional resolution.

The value proposition of outsourcing payroll is substantial: it significantly reduces the administrative burden on internal staff, ensures stringent compliance with complex federal, state, and local labor laws, minimizes the risk of costly errors and associated penalties, and generally improves operational efficiency within the organization. By entrusting payroll to specialists, businesses can free up their internal accounting staff to focus on higher-level tasks such as financial analysis and strategic planning.

Strategic Financial Leadership: Advisory and Analytical Roles

Beyond the foundational transactional tasks, outsourcing also provides access to higher-level financial expertise, enabling businesses to gain strategic insights, manage risk, and make informed decisions that drive long-term growth. The availability of outsourced roles like "Fractional CFOs" represents a significant shift. This means that even small and medium-sized businesses can now access strategic financial leadership that was once exclusive to large corporations. This effectively levels the playing field, allowing SMEs to benefit from sophisticated financial planning, advanced risk management, and robust growth strategies without incurring the prohibitive overhead costs associated with a full-time executive. This democratization of high-level expertise empowers smaller businesses to compete more effectively and make more informed, strategic decisions that were previously out of reach.

Financial Analysts: Driving Data-Driven Decisions

Outsourced financial analysts are instrumental in transforming raw financial data into actionable intelligence, providing valuable insights that drive strategic decision-making. Their responsibilities vary depending on their level of experience, but all contribute to a deeper understanding of a company's financial performance and profitability.

Junior Analyst Responsibilities:

- Financial Modeling and Business Plans: Assists in the foundational development of financial models and comprehensive business plans.

- Management Reports: Supports the preparation of routine monthly and quarterly management reports.

- Financial Data Analysis: Performs initial analysis of financial data, including basic variance reporting to identify deviations from budgets or forecasts.

- Dashboard Creation: Contributes to the development of financial dashboards and data visualizations to present key metrics clearly.

- Data Gathering and Validation: Collaborates with senior analysts to collect and validate financial data from various sources.

Mid-Level Analyst Responsibilities:

- Financial Models: Creates more detailed and complex financial models to support specific business decisions, such as investment appraisals or new project feasibility.

- Financial Statement Analysis and Forecasting: Conducts in-depth analysis of financial statements (income statements, balance sheets, cash flow statements) and develops financial forecasts to predict future performance.

- Management Dashboards and Reports: Prepares customized management dashboards and financial reports, providing tailored insights for leadership.

- Scenario and Sensitivity Analyses: Performs analyses to understand how financial outcomes change under different assumptions or market conditions.

- Budgeting, Investment Evaluation, and Cost Control: Supports the development of budgets, evaluates potential investments, and contributes to cost control initiatives.

Senior Analyst Responsibilities:

- Financial Models and Investment Reports: Leads the preparation of highly detailed financial models and comprehensive investment reports.

- Advanced Financial Analysis: Conducts sophisticated financial analysis, including replacement cost analysis, complex ratio analysis, and multi-scenario evaluations.

- Strategic Business Plans and Performance Dashboards: Develops overarching strategic business plans and designs executive-level performance dashboards.

- Guidance and Review: Provides mentorship and guidance to junior analysts and rigorously reviews their work to ensure accuracy and quality.

- Presenting Insights and Decision-Making: Presents complex financial insights to senior leadership and actively supports high-level financial decision-making processes.

The value proposition of an outsourced financial analyst is significant: they provide valuable insights into a company's performance and profitability, which are crucial for strategic decision-making, optimizing cash flow, and identifying growth opportunities. Their expertise spans various industries, allowing them to deliver tailored financial solutions that help businesses analyze data more effectively and make smarter, data-driven choices.

Tax Accountants: Navigating the Complexities of Compliance

Outsourced tax accountants specialize in the intricate and ever-changing landscape of tax laws, providing essential services that ensure compliance and optimize a business's tax position. While specific detailed responsibilities were not fully elaborated in the provided snippets, their core functions are critical for any business operating in the US.

Their primary responsibilities include:

- Tax preparation: Preparing and reviewing all necessary federal, state, and local tax returns for the business, ensuring accuracy and completeness.

- Tax filing: Submitting tax documents to the appropriate government authorities by statutory deadlines.

- Compliance with tax requirements: Ensuring that all tax-related activities adhere to the latest tax laws and regulations, thereby minimizing the risk of penalties or audits.

- Identifying deductions and credits: Proactively identifying all available tax deductions, credits, and incentives that can legally reduce a business's tax liabilities.

- Tax planning: Providing strategic advice on tax implications of business decisions, helping to structure operations in a tax-efficient manner.

- Coordination with controllers: Collaborating with internal or outsourced controllers to ensure that financial data is accurately prepared and reconciled for tax filings.

The value proposition of an outsourced tax accountant is clear: they minimize tax liabilities through expert planning and accurate filing, ensure strict adherence to the constantly evolving tax laws, and significantly reduce the administrative burden and stress associated with tax compliance for business owners. Their specialized knowledge helps businesses avoid costly errors and navigate the complexities of tax regulations with confidence.

Internal Auditors: Fortifying Controls and Mitigating Risk

Outsourced internal auditors provide an independent and objective assessment of an organization's internal controls, risk management processes, and governance frameworks. They function much like an in-house internal audit team, applying a systematic and disciplined approach to evaluate both tangible and intangible aspects of operations.

Their typical responsibilities span several critical areas:

- Financial Audits:

- Reviewing financial statements: Ensuring the accuracy and compliance of financial statements with established accounting standards.

- Evaluating internal controls: Assessing the effectiveness of financial controls designed to prevent fraud, errors, and misstatements.

- Auditing financial transactions: Verifying the integrity and validity of financial transactions, from revenue recognition to expense recording.

- Operational Audits:

- Assessing efficiency and effectiveness: Evaluating how well operational processes are functioning and identifying areas for improvement.

- Recommending process improvements: Suggesting ways to streamline operations, reduce waste, and enhance productivity.

- Ensuring policy compliance: Verifying that operations adhere to internal company policies and procedures.

- Compliance Audits:

- Checking adherence to regulations: Ensuring the organization complies with relevant laws, industry standards, and external regulations.

- Evaluating risk management practices: Assessing the effectiveness of existing risk management frameworks and proposing strategies for mitigating identified risks.

- Reviewing documentation: Ensuring proper record-keeping and documentation for compliance purposes.

Upon completion of their evaluations, outsourced internal auditors present a comprehensive report. This report details the company's current status in relation to its strategic goals, outlines existing and potential future risks, describes how current risks are being managed, and highlights specific areas where improvements can be made.

The value proposition of outsourced internal auditors is significant: they provide objectivity and independence, which are crucial for unbiased evaluations. They help identify blind spots in risk assessment, maximize the effective use of internal systems, and ensure robust regulatory compliance, thereby mitigating the potential for fraud and errors. This external perspective can invigorate risk assessment processes and provide diplomatic advisory work free from internal politics.

Fractional CFOs: High-Level Strategy Without the High Cost

Fractional Chief Financial Officers (CFOs) offer comprehensive strategic financial leadership tailored to the specific needs of a business, providing high-level expertise without the substantial overhead of a full-time executive salary. This model is particularly beneficial for small and medium-sized businesses that require strategic financial guidance but may not have the budget or consistent need for a dedicated, in-house CFO.

The scope of work for an outsourced CFO is highly flexible and customized, encompassing a wide array of services from fundamental financial guidance to extensive support in business strategy development. Their key responsibilities generally fall into four main categories:

Fiscal Activity Management: This involves the oversight and active management of the business's financial transactions and overall financial health. Specific tasks include:

- Tracking and reconciling accounts to ensure accuracy and consistency.

- Identifying areas of financial risk and opportunities for optimization.

- Providing regular reports on the current financial health of the business.

- Gathering and monitoring critical financial data, such as sales revenues and expenditures.

- Organizing and overseeing internal audits to ensure compliance and identify inefficiencies.

- Managing tax payments and ensuring timely and accurate submissions.

Financial Planning & Budgeting: Outsourced CFOs are instrumental in crafting detailed financial plans that guide the business toward its strategic objectives. Their responsibilities in this area include:

- Forecasting cash flow and sales projections to anticipate future financial positions.

- Preparing comprehensive financial statements for internal review and external stakeholders.

- Creating detailed budgets and income statements to allocate resources effectively.

- Analyzing financial trends to identify patterns and inform future strategies.

- Identifying and evaluating potential investment opportunities.

Strategic Planning & Business Analysis: This involves helping the business gain a competitive edge and establish authority within its industry. A fractional CFO achieves this by:

- Collecting and analyzing data related to overall business performance.

- Identifying areas ripe for improvement and developing actionable strategies to achieve specific goals.

- Guiding decision-making processes concerning investments, operational efficiency, and market positioning.

- Developing competitive pricing models to optimize revenue and market share.

- Creating and continuously monitoring key performance indicators (KPIs) to track progress against strategic objectives.

- Developing long-term plans for sustainable growth and success.

Risk Management & Compliance: Outsourced CFOs play a pivotal role in understanding and mitigating potential business risks, while simultaneously ensuring stringent regulatory adherence. Their tasks include:

- Monitoring government regulations and industry changes to ensure ongoing compliance.

- Creating robust compliance processes and procedures to minimize legal and financial exposure.

- Evaluating potential risk factors and devising proactive mitigation strategies.

- Developing plans for disaster recovery and robust cybersecurity measures to protect critical assets.

- Managing financial audits and providing comprehensive reports to stakeholders.

The value proposition of a fractional CFO is immense: they provide access to high-level financial counsel and strategic planning expertise without the premium salary and benefits package associated with a full-time executive. This enables businesses to shape critical growth strategies, refine investment plans, and navigate complex mergers and acquisitions with expert guidance.

The table below provides a concise overview of these common outsourced F&A roles and their key responsibilities, highlighting the primary benefit each brings to a business.

Choosing Your Path: Outsourcing Models and Strategic Considerations

The outsourcing landscape is not monolithic; it offers a diverse array of models, each presenting distinct advantages and inherent trade-offs. The selection of the most appropriate model and the right outsourcing partner is a critical strategic decision. This choice must be meticulously aligned with a business's specific operational needs, budgetary constraints, and overarching strategic priorities to ensure a successful and mutually beneficial partnership.

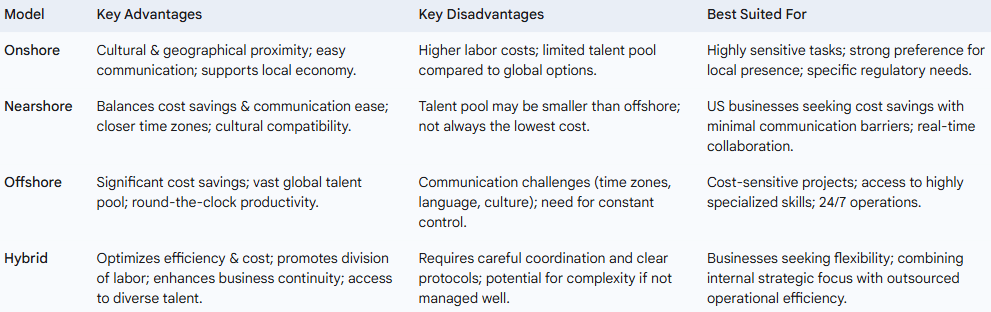

A Spectrum of Solutions: Onshore, Nearshore, Offshore, and Hybrid Models

Understanding the nuances of each outsourcing model is essential for making an informed decision. These models represent a spectrum of geographical and operational arrangements, each with its own set of benefits and challenges.

Onshore Outsourcing

- Definition: Onshore outsourcing, also known as domestic outsourcing, involves contracting work to an external organization located within the same country as the client business.

- Advantages: The primary benefit is the inherent cultural and geographical proximity, which significantly simplifies communication and collaboration. There are no time zone differences, and cultural norms are shared, fostering smoother interactions. While not always the cheapest option, it can offer potentially more cost-effective solutions in regions within the US where labor costs are lower than major metropolitan areas. Furthermore, onshoring allows businesses to directly support and invest in their own country's economy, contributing to local development and job creation, and mitigating risks associated with international business operations.

- Disadvantages: Typically, onshore outsourcing involves higher labor costs compared to both nearshore and offshore models, which can significantly impact the overall budget for cost-sensitive projects. Talent availability and competition for specialized skills can still be a challenge within certain domestic markets.

Nearshore Outsourcing

- Definition: Nearshore outsourcing involves contracting work to a neighboring country or a country in close geographical proximity to the client. For US businesses, this often includes countries in Latin America, such as Mexico and Argentina, which share similar or minimal time zone differences.

- Advantages: This model strikes a beneficial balance between cost savings and ease of communication and cultural compatibility. Geographical proximity means closer or overlapping time zones, facilitating smoother real-time collaboration and reducing delays in communication. Neighboring countries often share similar cultural values, work ethics, and business practices, which fosters stronger working relationships, enhances understanding, and leads to smoother collaboration. Nearshore candidates often have lower salary expectations than their US counterparts without compromising on skill or experience, making it a cost-effective solution for budget-conscious companies that prioritize quality.

- Disadvantages: While offering a broader talent pool than onshore options, nearshoring may still have limitations in terms of the sheer volume and diversity of available talent compared to larger offshore locations.

Offshore Outsourcing

- Definition: Offshore outsourcing entails hiring an external organization located in a different continent or a geographically distant country from the client's primary operations. Common destinations for F&A outsourcing include India and the Philippines.

- Advantages: The most significant advantage is the potential for substantial cost savings, primarily due to much lower labor costs in offshore locations compared to in-house teams or even nearshore options. Offshoring provides access to a vast and diverse global talent pool, allowing businesses to tap into highly skilled professionals and specialized expertise that might not be available locally. This enables rapid scaling of operations. Furthermore, by leveraging significant time zone differences, offshore outsourcing can facilitate round-the-clock productivity, often referred to as a "follow-the-sun" model, where work is seamlessly handed off between teams across different time zones.

- Disadvantages: A major drawback is the increased need for constant control and management due to the greater geographical distance. Communication and coordination can be challenging due to significant time zone differences, pronounced cultural disparities, and potential language barriers, which can lead to misunderstandings and delays.

Hybrid Outsourcing

- Definition: A hybrid outsourcing model represents a sophisticated blend of in-house staff with external specialists, often combining elements of onshore, nearshore, and/or offshore models. This approach seeks to optimize the strengths of different models.

- Advantages: This model synergizes the inherent strengths of various outsourcing approaches, optimizing efficiency and cost without compromising on quality. It promotes a better division of labor, allowing complex and critical job functions to remain with in-house teams who possess deep local market knowledge, while non-critical or time-sensitive tasks are delegated to outsourced staff. Collaboration and operational control are enhanced through the strategic use of messaging and video-conferencing software, facilitating regular meetings and feedback sessions. Hybrid outsourcing significantly increases access to a global talent pool, enabling businesses to quickly close skill gaps and leverage specialized expertise from around the world. Crucially, it enhances business continuity by diversifying teams across different locations, providing a robust backup plan against local disruptions such as natural disasters or health crises. This model also allows for the engagement of fractional CFO services, providing high-level financial counsel without the premium salary associated with a full-time executive.

- Value Proposition: The hybrid model offers unparalleled flexibility, cost-effectiveness, and access to specialized skills, culminating in a smarter, more resilient business model that can adapt to evolving challenges and opportunities.

The detailed comparison of outsourcing models reveals that the choice is not solely driven by cost. It is a strategic decision based on a nuanced understanding of the trade-offs between cost, communication ease, cultural compatibility, and talent pool access. Nearshoring, for example, often emerges as a "sweet spot" for US businesses, indicating a shift towards more balanced strategic considerations where factors beyond the lowest price, such as smoother communication and cultural alignment, are increasingly valued. The rise of the hybrid model signifies an evolution in outsourcing strategy, moving beyond a simple "all-in or all-out" approach to a sophisticated co-management framework. This indicates that businesses are seeking to leverage external expertise while retaining internal control over strategic functions, optimizing for both efficiency and competitive advantage. This approach acknowledges that not all tasks are equally suitable for full outsourcing, and a blended model can yield superior results by combining internal business familiarity with external specialized expertise.

The table below provides a comparative analysis of the primary outsourcing models, highlighting their key advantages, disadvantages, and the scenarios for which they are best suited.

The contemporary business landscape demands unprecedented levels of agility, efficiency, and strategic focus. For US business owners, the intricate and often burdensome domain of accounting and finance can divert invaluable resources and attention from core growth initiatives. This comprehensive analysis underscores that Finance and Accounting (F&A) outsourcing is no longer merely a tactical cost-cutting measure; it has evolved into a strategic imperative, offering a multi-dimensional solution to the complex financial challenges faced by modern enterprises.

The transformative power of F&A outsourcing is evident in its ability to directly address key pain points. It delivers significant cost savings by eliminating the overheads of in-house teams, with quantifiable reductions in F&A expenses often ranging from 20% to 75%. This financial liberation allows for the strategic reallocation of capital towards core business development, marketing, and innovation. Beyond cost, outsourcing provides unparalleled access to specialized expertise and a global talent pool, effectively circumventing the acute talent shortages plaguing the accounting profession. This ensures businesses can access high-caliber bookkeepers, payroll specialists, financial analysts, and even fractional CFOs, who bring diverse industry experience and up-to-date regulatory knowledge.

Operational efficiency is profoundly enhanced through the seamless integration of advanced cloud-based accounting tools and sophisticated automation technologies. This delivers real-time financial data, automates repetitive tasks, and provides predictive insights, transforming financial management from a reactive process into a proactive, data-driven function. Furthermore, outsourcing offers crucial flexibility and scalability, allowing businesses to effortlessly adjust financial operations to match fluctuating demands, market shifts, or periods of rapid growth or contraction. This inherent adaptability also fortifies business continuity, providing resilience against unforeseen disruptions. Critically, outsourcing strengthens compliance, data security, and risk management. Reputable providers adhere to stringent global and US-specific regulations (e.g., GDPR, SOX, CCPA) and implement robust cybersecurity measures, safeguarding sensitive financial data and mitigating the profound risks of non-compliance and data breaches.

Ultimately, the most profound benefit for business owners is the reclamation of their time and mental bandwidth. By entrusting specialized financial functions to external experts, leaders can shift their focus from operational firefighting to strategic leadership, driving innovation, enhancing customer satisfaction, and accelerating long-term business growth. This is a non-financial, yet highly impactful, return on investment.

The success of an outsourced F&A strategy hinges on a well-managed partnership. This necessitates diligent vendor selection based on expertise, reputation, communication, and technological capabilities. It requires crafting robust Service Level Agreements (SLAs) that clearly define expectations, metrics, and accountability. Consistent communication protocols, leveraging modern tools, are essential to bridge geographical distances and foster operational harmony. Finally, data-driven performance monitoring through Key Performance Indicators (KPIs) ensures continuous improvement and measurable value delivery.