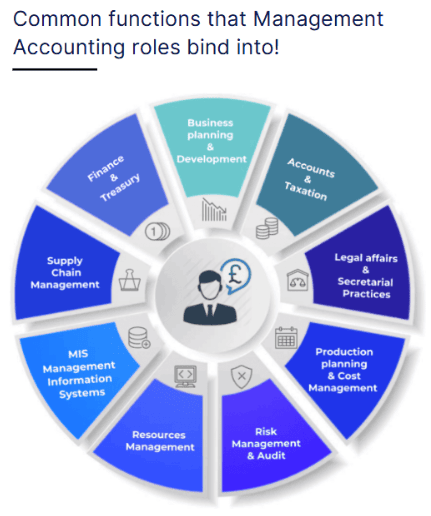

The contemporary business landscape in the United States is characterized by relentless competition, rapid technological advancements, and dynamic market shifts. For many organizations, particularly small and medium-sized enterprises (SMEs), maintaining agility, optimizing efficiency, and sustaining strategic focus are paramount for survival and growth. Within this demanding environment, the intricate and often resource-intensive domain of accounting and finance frequently absorbs disproportionate amounts of time and capital, diverting critical attention from core operational and strategic imperatives. This introductory section establishes the burgeoning recognition among business leaders that traditional, fully in-house financial management models may no longer represent the most effective or sustainable approach. Finance and Accounting (F&A) outsourcing involves the strategic delegation of various financial functions to external service providers. This encompasses a broad spectrum of tasks, ranging from fundamental transactional processes like bookkeeping, payroll management, and tax preparation to more complex and strategic functions such as accounts payable and accounts receivable management, and high-level financial planning and analysis. This operational model allows businesses to leverage specialized expertise and advanced technologies without the associated overheads of an internal department.

The immediate value proposition of F&A outsourcing lies in its direct ability to address common financial pain points experienced by US businesses. By entrusting these specialized functions to external experts, organizations can significantly optimize costs, enhance operational efficiency, and gain access to a depth of expertise that might otherwise be unattainable. This strategic shift transforms financial management from a burdensome necessity into a powerful lever for competitive advantage, enabling business owners to reallocate resources and focus on activities that directly drive innovation and market expansion.

The Modern Financial Landscape: Challenges & Opportunities for US Businesses

The operational realities for US business owners are complex, often requiring them to assume multiple roles simultaneously. Beyond their primary entrepreneurial vision, they frequently find themselves navigating responsibilities typically assigned to marketing managers, human resources directors, and customer service representatives. This multi-faceted engagement, while showcasing versatility, renders effective financial management particularly arduous. The inherent demands of recording, summarizing, and analyzing financial transactions can overwhelm internal capacities, creating significant operational bottlenecks and strategic limitations.

Navigating Common Accounting and Financial Pain Points

The challenges inherent in managing accounting and finance functions are pervasive across US businesses, particularly within the SME sector. These difficulties often transcend mere inconvenience, directly impacting a company's stability and growth trajectory. One of the most critical and frequently cited pain points is cash flow management. Poor cash flow is not merely an inconvenience; it is a fundamental vulnerability, identified as the cause of 82% of small business failures. Businesses frequently struggle with effectively tracking the status of invoices and payments, leading to a lack of clear visibility into their cash flow and liabilities. Inefficient accounts payable processes can escalate processing costs per invoice, including labor, and incur potential penalties for late payments. Furthermore, diligently collecting customer payments, a seemingly straightforward task, often proves challenging, impacting the inflow of funds. Seasonal businesses face exacerbated challenges in managing irregular cash flow patterns, where periods of high revenue are offset by lean months, necessitating meticulous financial foresight.

The realm of financial reporting and analysis also presents considerable hurdles. Beyond the routine tasks of day-to-day bookkeeping, many businesses lack the capability to consistently analyze financial reports for deeper insights, early warning signs, or emerging opportunities. This deficiency in analytical capacity hinders informed decision-making, particularly for entities seeking external investment or undergoing financial reviews and audits, where well-documented and insightful records are expected by lenders, investors, and tax authorities. The core difficulty often lies not in generating data, but in discerning which metrics truly matter to various stakeholders and how to extract actionable intelligence from disparate data sources.

Tax planning and compliance represent a perpetual source of stress and complexity. The labyrinthine nature of federal and state tax laws, coupled with their constant evolution, makes accurate planning and timely filing a formidable task. Varying state regulations regarding tax rates, credits, and deductions, alongside the complexities introduced by remote workforces, make tracking tax-deductible expenses and ensuring correct withholdings exceptionally difficult. Failure to meet estimated quarterly tax obligations or comply with specific regulations can result in substantial fines and penalties.

Payroll management is another area fraught with potential pitfalls. This function demands meticulous attention to detail and stringent compliance with local labor laws. Errors in employee classification, incorrect tax filings, inaccurate employee payments, or improper tracking of time off can lead to costly penalties and legal repercussions. Effective expense tracking is vital for profitability, yet it often becomes unwieldy. Saving and categorizing every receipt, systematically reviewing monthly expenses, and accurately identifying legitimate tax deductions can be time-consuming and prone to oversight. Unthinking bill payments without proper reconciliation can lead to double payments or undetected errors, resulting in financial losses.

A significant underlying issue is the pervasive practice of Do-It-Yourself (DIY) accounting. While seemingly cost-effective initially, attempting to handle all accounting functions internally without specialized expertise frequently results in critical errors, such as overpaying or underpaying taxes, poor tax compliance, or duplicate invoice payments. This approach, rather than saving resources, often diverts the business owner's invaluable time and energy away from core business growth activities, ultimately proving more costly in the long run. The fundamental problem here is not merely about managing tasks; it is about a critical expertise gap that directly translates into business vulnerability. When business owners, despite their entrepreneurial acumen, attempt to navigate the complexities of financial management without specialized knowledge, it leads to inefficient processes and a lack of critical financial insights. This, in turn, increases financial risk and can even jeopardize the fundamental viability of the business. The chain of events is clear: a deficit in internal accounting expertise, often stemming from DIY attempts, leads to flawed financial operations, which then exposes the business to significant risks, including the high rate of failure linked to poor cash flow management.

Finally, the reluctance or inability to fully embrace accounting technology remains a challenge. Many small businesses continue to rely on outdated manual methods, such as basic Excel spreadsheets, for their financial tracking. This resistance to adopting modern accounting software and automation tools means they miss out on significant gains in efficiency, control, and real-time financial visibility. The perception of accounting software as an unnecessary expense, or a hesitation to learn new systems, can hinder growth and limit a business's potential. The constant evolution of tax laws and regulatory frameworks, coupled with the inherent apprehension surrounding audits, underscores a substantial compliance burden. This burden is not simply an administrative inconvenience; it represents a profound strategic drain on resources. Business owners find themselves pulled away from vital growth-oriented activities—such as product development, market expansion, or customer engagement—to dedicate time and mental energy to ensuring regulatory adherence. In this context, outsourcing financial compliance becomes more than a convenience; it transforms into a strategic imperative. It offers regulatory peace of mind by entrusting complex, ever-changing requirements to specialized experts, thereby enabling the reallocation of internal resources towards initiatives that directly drive business growth and competitive advantage.

The contemporary business landscape demands unprecedented levels of agility, efficiency, and strategic focus. For US business owners, the intricate and often burdensome domain of accounting and finance can divert invaluable resources and attention from core growth initiatives. This comprehensive analysis underscores that Finance and Accounting (F&A) outsourcing is no longer merely a tactical cost-cutting measure; it has evolved into a strategic imperative, offering a multi-dimensional solution to the complex financial challenges faced by modern enterprises.

The transformative power of F&A outsourcing is evident in its ability to directly address key pain points. It delivers significant cost savings by eliminating the overheads of in-house teams, with quantifiable reductions in F&A expenses often ranging from 20% to 75%. This financial liberation allows for the strategic reallocation of capital towards core business development, marketing, and innovation. Beyond cost, outsourcing provides unparalleled access to specialized expertise and a global talent pool, effectively circumventing the acute talent shortages plaguing the accounting profession. This ensures businesses can access high-caliber bookkeepers, payroll specialists, financial analysts, and even fractional CFOs, who bring diverse industry experience and up-to-date regulatory knowledge.

Operational efficiency is profoundly enhanced through the seamless integration of advanced cloud-based accounting tools and sophisticated automation technologies. This delivers real-time financial data, automates repetitive tasks, and provides predictive insights, transforming financial management from a reactive process into a proactive, data-driven function. Furthermore, outsourcing offers crucial flexibility and scalability, allowing businesses to effortlessly adjust financial operations to match fluctuating demands, market shifts, or periods of rapid growth or contraction. This inherent adaptability also fortifies business continuity, providing resilience against unforeseen disruptions. Critically, outsourcing strengthens compliance, data security, and risk management. Reputable providers adhere to stringent global and US-specific regulations (e.g., GDPR, SOX, CCPA) and implement robust cybersecurity measures, safeguarding sensitive financial data and mitigating the profound risks of non-compliance and data breaches.

Ultimately, the most profound benefit for business owners is the reclamation of their time and mental bandwidth. By entrusting specialized financial functions to external experts, leaders can shift their focus from operational firefighting to strategic leadership, driving innovation, enhancing customer satisfaction, and accelerating long-term business growth. This is a non-financial, yet highly impactful, return on investment.

The success of an outsourced F&A strategy hinges on a well-managed partnership. This necessitates diligent vendor selection based on expertise, reputation, communication, and technological capabilities. It requires crafting robust Service Level Agreements (SLAs) that clearly define expectations, metrics, and accountability. Consistent communication protocols, leveraging modern tools, are essential to bridge geographical distances and foster operational harmony. Finally, data-driven performance monitoring through Key Performance Indicators (KPIs) ensures continuous improvement and measurable value delivery.